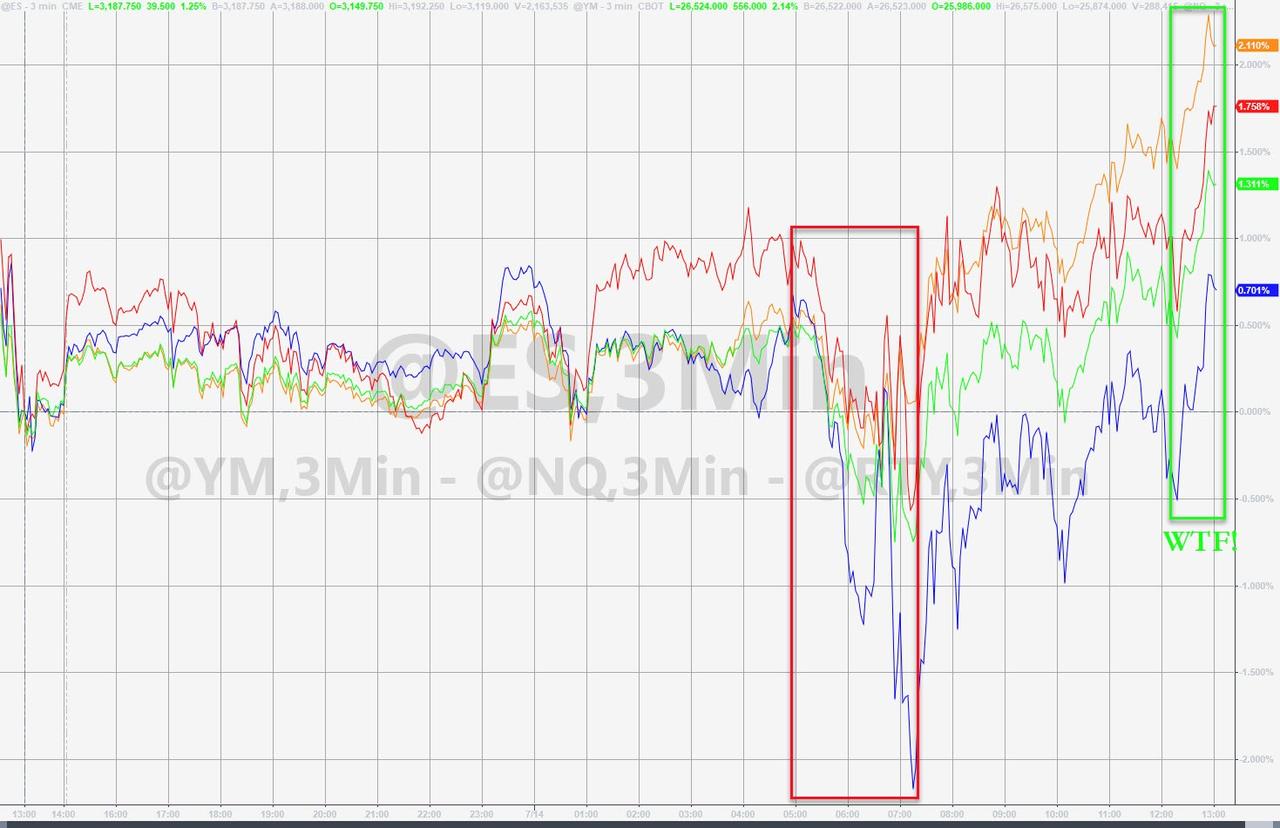

Tyler Durden Tue, 07/14/2020 - 16:00 A volatile day got ugly fast early triggered by the inflation data but was rescued by relatively positive virus reports from various states sparking the usual buying panic in stocks. A late-day panic-bid rescued everything of course as a MoC buy hit the tape...The Dow rose 600 points, back above yesterday's highs, finding support early on at the 200DMA...From the June 8th highs, the non-Nasdaq indices are coming back a little...But, Nasdaq was the laggard once again with The Dow outpacing it for the 3rd straight day - the biggest outperformance in 4 months...And while stocks overall were bid (led by the Dow), investors also bought bonds...Source: BloombergThey also bought bullion...Source: BloombergAnd they bought Bitcoin...Source: BloombergYou want the truth!You can't handle the truth!Value outperformed Growth for the second day in a row...Source: BloombergFANG Stocks plunged over 10% from yesterday's highs before bouncing back intraday...Source: BloombergTSLA could not hold its manipulated opening ramp gains for the second day in a row...WFC was ugly as JPM clung to gains after earnings...Source: Bloomberg10Y Treasury yield closed near 3-month lows...Source: BloombergThe Dollar reverted back to the lower end of its recent range...Source: BloombergCryptos were mixed today, weak overnight but bid from the European open...Source: BloombergCommodities didn't move too much today aside from oil which bounced during the US day session (ahead of tonight's inventory data)Source: BloombergAnd finally, for all those panicking about a "second wave" and demanding nationwide lockdowns, perhaps an uncomfortable glance at the rate of deaths might change your mind about just how much hysteria is required...Source: Bloomberg

Tyler Durden Tue, 07/14/2020 - 16:00 A volatile day got ugly fast early triggered by the inflation data but was rescued by relatively positive virus reports from various states sparking the usual buying panic in stocks. A late-day panic-bid rescued everything of course as a MoC buy hit the tape...The Dow rose 600 points, back above yesterday's highs, finding support early on at the 200DMA...From the June 8th highs, the non-Nasdaq indices are coming back a little...But, Nasdaq was the laggard once again with The Dow outpacing it for the 3rd straight day - the biggest outperformance in 4 months...And while stocks overall were bid (led by the Dow), investors also bought bonds...Source: BloombergThey also bought bullion...Source: BloombergAnd they bought Bitcoin...Source: BloombergYou want the truth!You can't handle the truth!Value outperformed Growth for the second day in a row...Source: BloombergFANG Stocks plunged over 10% from yesterday's highs before bouncing back intraday...Source: BloombergTSLA could not hold its manipulated opening ramp gains for the second day in a row...WFC was ugly as JPM clung to gains after earnings...Source: Bloomberg10Y Treasury yield closed near 3-month lows...Source: BloombergThe Dollar reverted back to the lower end of its recent range...Source: BloombergCryptos were mixed today, weak overnight but bid from the European open...Source: BloombergCommodities didn't move too much today aside from oil which bounced during the US day session (ahead of tonight's inventory data)Source: BloombergAnd finally, for all those panicking about a "second wave" and demanding nationwide lockdowns, perhaps an uncomfortable glance at the rate of deaths might change your mind about just how much hysteria is required...Source: BloombergFull Post Here - Dow Outpaces Nasdaq For 3rd Straight Day; Bonds, Bullion, & Bitcoin Bid